It is important to realize the decisions you make now about handling your finances and borrowing money will affect you in the future. Companies known as credit bureaus keep track of your debts and how you repay them by communicating with your lenders. These same agencies make this information available to other lenders in the form of a Credit Report or a Credit Score. Creditors, companies that issue lines of credit or services including car loans, use this information to determine just how much they want to lend you, and just how much they will charge you overall.

Your credit score represents your individual financial trustworthiness. The better your credit standing, the more likely creditors will be willing to work with you. By maintaining good credit, you will receive lower interest rates, lower payments, and greater ease in borrowing money. Good credit means that your history of payment, employment, residential status and salary make you a good candidate for a car loan.

Your credit score represents your individual financial trustworthiness. The better your credit standing, the more likely creditors will be willing to work with you. By maintaining good credit, you will receive lower interest rates, lower payments, and greater ease in borrowing money. Good credit means that your history of payment, employment, residential status and salary make you a good candidate for a car loan.

Conversely, bad credit can be a problem, and prevent creditors from doing business with you. Poor credit results when you make payments late or not in full, and even borrowing too much money can signal a red flag that you are over extended and may be unable to make payments. What does all this mean? Well, it means that you might have trouble getting car loans, a mortgage, credit cards, a place to live, and sometimes even a job. Good credit is important both now and in the future. In most cases, it takes seven years for accurate, negative information to be deleted from your credit report. Bankruptcy information takes even longer to be deleted, and may remain on your report for 10 years.

A poor credit history can haunt you for years, which is why its important to learn how to maintain good credit before there is a problem. The process may seem complicated at first, but it gets easier once you understand the basics of credit and how it works.

You can, and should, find out your credit score before you apply for credit. Some unscrupulous auto dealers have been known to lie about your credit score in order to give you a higher interest rate. You can access your credit score from FreeCreditScore.com.

Your credit payment history is recorded in a report maintained by consumer reporting agencies or credit bureaus such as Equifax, Trans Union and Experian. Your credit record contains information provided by businesses and public records – information such as court documents, property taxes, residence, income, debts, and credit payment history.

You have a right to review your credit payment history on file with the credit bureaus. The Fair Credit Reporting Act (FCRA) was established, in part, to ensure that accurate and complete information is maintained by the credit bureaus.

Frequently Asked Question: How does applying for an auto loan or car refinancing affect my credit score? For this, we went straight to the source to find out. Experian, one of the largest credit reporting agencies in the US states that any inquiries within a 14 day period are treated as one inquiry related to the impact on your credit score. Experian goes on to say, “Because credit scoring systems count multiple auto loan inquiries as a single inquiry, shotgunning does not affect a person’s ability to qualify for credit.” That inquiry affects your credit score 5-7 points depending on which credit reporting agency you are using. You can read in its entirety Experian’s Impact on Your Credit Score article here.

If you have been denied credit because of something in your credit report, you are entitled to a free credit report so you can see the evidence that the credit grantor relied on to make its decision. Even if you have not been denied credit, you can receive a copy of the report free once each year to determine its accuracy. This also depends on the state you live in. Other times the fee is nominal. It makes sense to check your credit report once a year to make sure all information reported is up to date and correct. If you find any mistakes, you have the right to get them corrected. You can request the reporting agency to investigate the disputed information and correct the error at no charge. You can also add a written statement to your credit file.

Though many local credit bureaus exist, three of the most well known and commonly used are:

| Equifax | Experian | Trans Union |

| PO Box 105496 | PO Box 2104 | PO Box 1000 |

| Atlanta, GA 30348-5496 | Allen, TX 75013-2104 | Chester, PA 19022 |

| (800) 997-2493 | (888) 397-3742 | (900) 888-4213 |

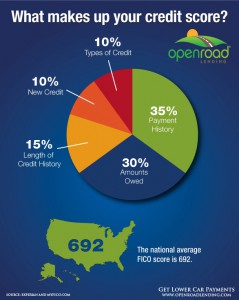

Banks and Lenders alike review your credit score to determine how they feel your future behavior will be related to any loan products they provide to you. The higher your credit score, the easier it is to qualify for any type of credit from renting an apartment to credit cards, auto loans and even a job. Many employers now look at your credit before hiring a potential employee to determine habits and character of a potential new hire. Here are a few tips to help boost your score:

1. Pay Your Bills On Time – Sounds easy, right? Your payment history is the single biggest factor in determining your credit score. If you are struggling making your payments on time, reach out to your lender and ask about alternative payment plans that could help you get back on track. Many also offer an automatic bill pay option that takes the money right out of your account on the due date.

2. Reduce Your Debt by Paying Down Your Larger Debts First – If there is any way possible, try and always pay more than the minimum payment amount. Start with the largest burden on you financially and try to get that one paid off first. Once you get that one tackled, move on to the next highest and continue that same process. Before you know it, you will have those high credit card balances paid.

3. Avoid New Credit – Only apply for new credit when you absolutely need it. The best way to boost your credit score is to keep revolving balances low and make all of those payments on time. If you are just starting to build credit, make sure you don’t open up to many accounts to soon.

4. Report Any Errors – You should review your credit report carefully for anything that you think could be wrong. Contact the credit bureau that sent the report in writing to correct any mistakes. Consumers should review their credit report at least once per year to identify mistakes or potential fraud taking place in your credit report.

5. Limit Your Shopping for Credit – Inquiries in your credit profile can lower your score. When you decide it is time to go out shopping for a car loan or mortgage, try to limit your shopping and pulling of your credit to within 14 days. Any pulls on your credit within that time frame has a limited adverse effect.

6. Stability – Creditors like stability, so they do not like it if you move around or change jobs frequently. Have a verifiable address. They need to be able to open the phone book and verify the information on your application.

Do Multiple Inquiries Have a Negative Effect On My Credit Score

Auto Loans – The Role Your Credit Plays

Car Loans for Bad Credit – What Options Exist?

Credit Scores Fall to New Lows

How to Get and Keep a Good Credit ScoreCar Refinance Misconceptions You Should Know